Welcome to the comprehensive guide on developing trading software. In this article, we will dive into the intricacies of creating powerful and efficient trading software solutions that can help traders analyze and execute their strategies with confidence.

Whether you are a seasoned developer or just starting out, you will find here valuable insights and practical tips to navigate the world of fintech software development successfully. Read on!

Online Trading Market Overview

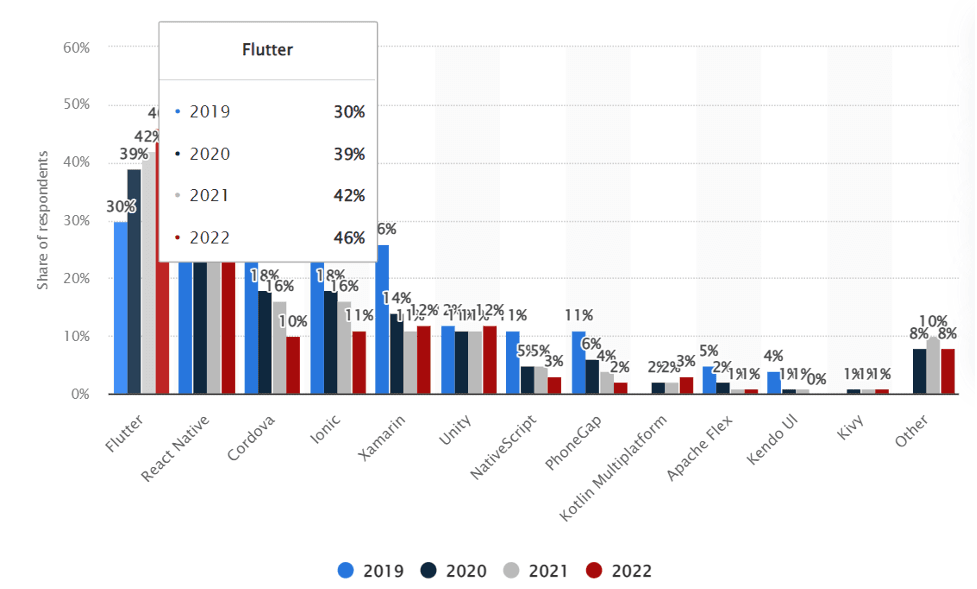

Following the coronavirus outbreak in 2020, millennial investors became more engaged in internet trading. From the second quarter of 2020 through 2021, many online brokers, including Robinhood, saw a discernible increase in the number of platform users. Online trade has grown in popularity as a result of its low-cost business model, technical integration, and social media advertising.

Source: Statista

In 2023, the global online trading market continues to evolve and expand, driven by innovative technology, increased accessibility, and greater investor interest. The market is characterized by the growing prevalence of mobile trading applications and digital platforms, enabling new means of communication, research, and strategic investing. Investors also benefit from convenient tools that facilitate real-time decision-making and portfolio management.

The rise of decentralized finance (DeFi) and cryptocurrencies is further pushing the boundaries of the online trading landscape. In turn, advancements in artificial intelligence (AI) and machine learning technologies have led to the development of sophisticated trading algorithms that can analyze large datasets rapidly. Some firms offer AI-driven services that can assist investors in making informed decisions based on complex trends or even automatically execute trades, thereby optimizing user investment strategies.

The Need for Automated Trading Software

Since manual trading requires careful monitoring of a lot of aspects, modern investors tend to automate their trading strategies.

Several important reasons fuel the rise of automated trading.

Firstly, it enhances the speed and accuracy of trade execution. Financial markets are highly competitive, with prices changing rapidly and opportunities vanishing within seconds. Automated software can analyze data and execute orders with unmatched speed and precision, improving the chances of seizing profitable opportunities.

Secondly, automated trading allows traders to diversify their investments efficiently. As markets grow increasingly complex and interconnected, investors must allocate resources across various assets. Automated software enables traders to manage multiple accounts or positions simultaneously and backtest different strategies without manual intervention.

Third, automated trading systems reduce the risk of human errors. In manual trading, making mistakes such as placing an incorrect order or overlooking critical information is easy. Automated software minimizes these risks by following predetermined rules and predefined algorithms.

How Trading Software Brings You Profit

What do you invest in, and how do you earn a return when trading system development software is an investment in and of itself?

Here's an explanation of how it can be profitable:

- Licensing fees: include payments for using the software, which can either be a one-time purchase or a subscription-based model.

- Market data and research tools: access to those is often bundled as a premium feature within the platform or offered as an add-on service, generating additional revenue from those who opt for these services.

- Trade fees: trading software allows for generating income via commissions on trades made through the platforms. This typically involves charging a small fee based on a percentage of trade value or a fixed fee per trade.

- Advertising and strategic partnerships: another avenue for making money is through advertising within platforms or forging strategic partnerships with financial institutions like banks or other brokerage firms who wish to use the platform technology in their own trading platforms.

There are rather obvious ways to make money here, and you can use any tactic you like to further your business objectives. A fair and open monetization model that provides a sizable return on investment is making money while assisting others in making money. With so many opportunities for commercialization, creators of the trading software can see a return on their investment in no time.

How can we help you achieve your digital goals?

Get in touchHow to Create a Trading Software

Note that before starting the development of custom trading platform itself, you need to select the algorithmic trading strategy. Let’s take a look at the most popular ones:

- Arbitrage: involves identifying price discrepancies between two or more markets and capitalizing on them by simultaneously buying and selling the same asset.

- Trend-following strategies: take positions in the market based on the prevailing direction of asset prices.

- Index fund rebalancing: employed by passive fund managers who attempt to match the performance of a benchmark index.

- Mathematical model-based strategies: the result of digital transformation in fintech are sophisticated mathematical models and algorithms that analyze market data and determine optimal trading decisions.

- Mean reversion or trading range: based on the principle that asset prices will eventually revert to their historical mean values after periods of significant deviation.

- Volume-weighted average price (VWAP): aims to minimize the impact of trades on the market price.

- Time-weighted average price (TWAP): helps reduce market impact but focuses on evenly distributing an order over a specified time period rather than volume.

- Percentage of volume (POV): comprises executing a target order size that equals a specified percentage of the total asset trading volume.

- Implementation shortfall: aims to minimize the difference between the decision price and the final execution price.

- Other non-usual trading algorithms: less conventional trading strategies implemented by market participants to gain a competitive edge.

Once you decide on the algorithmic strategy that suits your future product, it’s time to get hands-on with the development process.

Defining Requirements

The first step in creating trading software is to determine its requirements. This involves understanding the target audience, market trends, and identifying critical features that meet the needs of the traders. It is essential to ensure that the software is well-defined and caters to a specific trading market.

Make sure that all transactions adhere to the rules and legislation of the many nations involved in order to give users security. A database of fintech laws that includes laws from approximately 200 nations was established by the World Bank. This tool allows you to search for information based on several parameters.

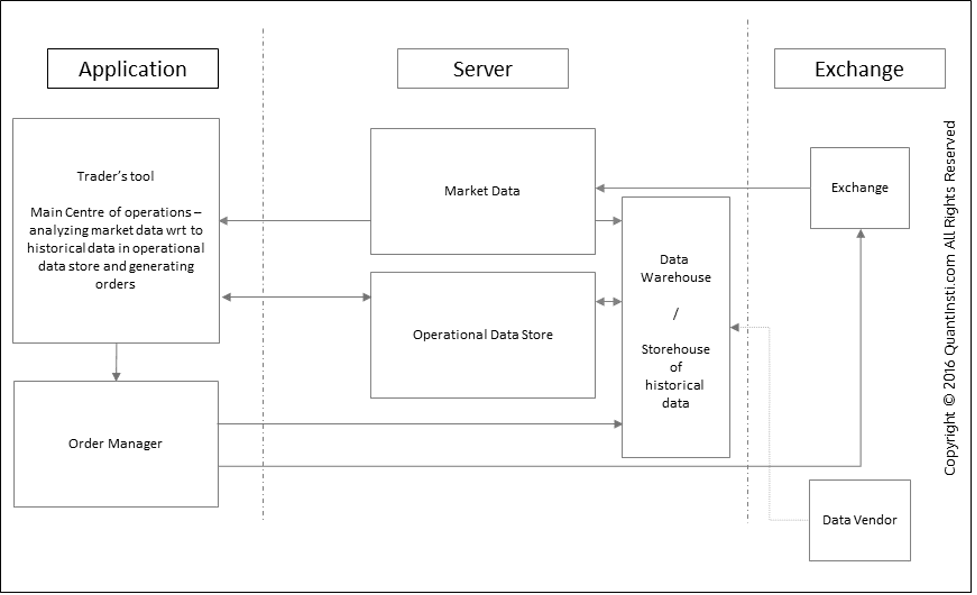

Designing the Architecture

After defining the requirements, the next step is to design the architecture of the software. This involves identifying the necessary frameworks, tools, and technologies that will be required to build the trading software. The software should be designed in a way that it can handle the trading workflow and allow for easy integration with other systems.

Source: Quantinsi

Developing the Software

Once the architecture is in place, the trading software development process can begin. This involves coding, designing the UI/UX, and testing the software. The software development team must work collaboratively throughout the development process to ensure the software is technically sound and all requirements are met.

Integration with Data-feeds

The trading software must integrate with data feeds to provide real-time trading data to the traders. The software should be able to handle complex data feeds, such as market feeds, news feeds, social media feeds, etc.

Testing and Quality Assurance

Before going public with the newly developed software, developers should conduct testing and ensure its high quality. The QA testing process should verify the software's functionality, identify any bugs, and ensure no security vulnerabilities.

Deployment

After successful testing, the trading software is ready for deployment. The software's deployment process should be carefully managed to ensure a smooth transition to production systems and minimize operational disruptions.

Maintenance and Support

After deployment, the trading software requires ongoing maintenance and support. This includes addressing any technical issues, keeping the software updated, and ensuring its continued availability to the traders.

Must-Have Features of Trading Software

To build a good trading platform, companies should consider a range of functional features to aid in trading. These include:

Dashboard with Statistical Information

A dashboard presents important information such as market trends, historical data, trade volume, and market analysis. It should be customizable, allowing traders to personalize it based on their preferences.

Authentication

Security should be the number one concern when developing trading software. A safe and reliable authentication system (two-factor authentication, encrypted passwords, and session monitoring) ensures unauthorized individuals do not access the platform.

Convenient CRM and User Functionality

Traders need a user-friendly platform with convenient CRM functionality. Such features help traders manage their accounts, hold onto vital information, and carry out transactions with ease.

Fast Searching and Filtering Tools

Develop a trading platform that is fast and efficient to help users avoid transaction delays. It should have computing resources that enable traders to filter and access real-time market data quickly.

Alerts

Alerts allow users to keep an incisive watch over the market. However, this feature is best when customizable so as not to resemble spam. Enable traders to customize notifications based on market conditions, stock movements, or other factors.

Newsfeed

A newsfeed feature gives users access to the latest financial news, market events, and other vital information that could affect their trading decisions. Traders need the ability to select their preferred news sources and customize their feeds on the platform.

Withdrawals & Payments

Companies should build a trading platform with quick and simplified payment features for withdrawals and deposits. This is vital for user convenience. Traders should be able to withdraw their funds with a click of a button, and deposits must be instantaneous.

Portfolio

It is essential to enable traders to monitor and regulate trading portfolios. This feature should present profit margins, risk levels, and possible trading movements.

Community

A trading platform should have a community feature that enables users to share insights and thoughts with various stakeholders, such as other traders, brokers, and market experts.

Personal Analytics Data Dashboard

This feature gives traders an overview of their trading decisions, market analysis, and profit margins, among others. It helps them refine their trading strategies, thus improving their overall performance.

Transform your vision into reality with Clover Dynamics.

Get in touchFinal Word

Developing trading software is a complex yet rewarding endeavor. By prioritizing user experience, adhering to market regulations, and incorporating the latest technologies, such as AI and machine learning, you can create a powerful tool that benefits both novice and experienced traders. Keep in mind the importance of rigorous testing and ongoing updates to maintain the software's accuracy and reliability. By following these guidelines, you are well on your way to creating a sophisticated trading solution that positively impacts the financial market ecosystem.

We hope you found this piece helpful. To learn more about the state of the fintech industry, visit our blog.

To create exceptional high-quality trading software, contact our team.