Best Practices for Fintech Application Development Security

Share this post

The highest level of security in a fintech application development is a must. More individuals and businesses rely on digital financial services daily, pressing fintech software development companies to build safe, dependable solutions that maintain customer trust. This article will explore some of the best fintech app security solutions that help protect financial transactions and sensitive information from threats.

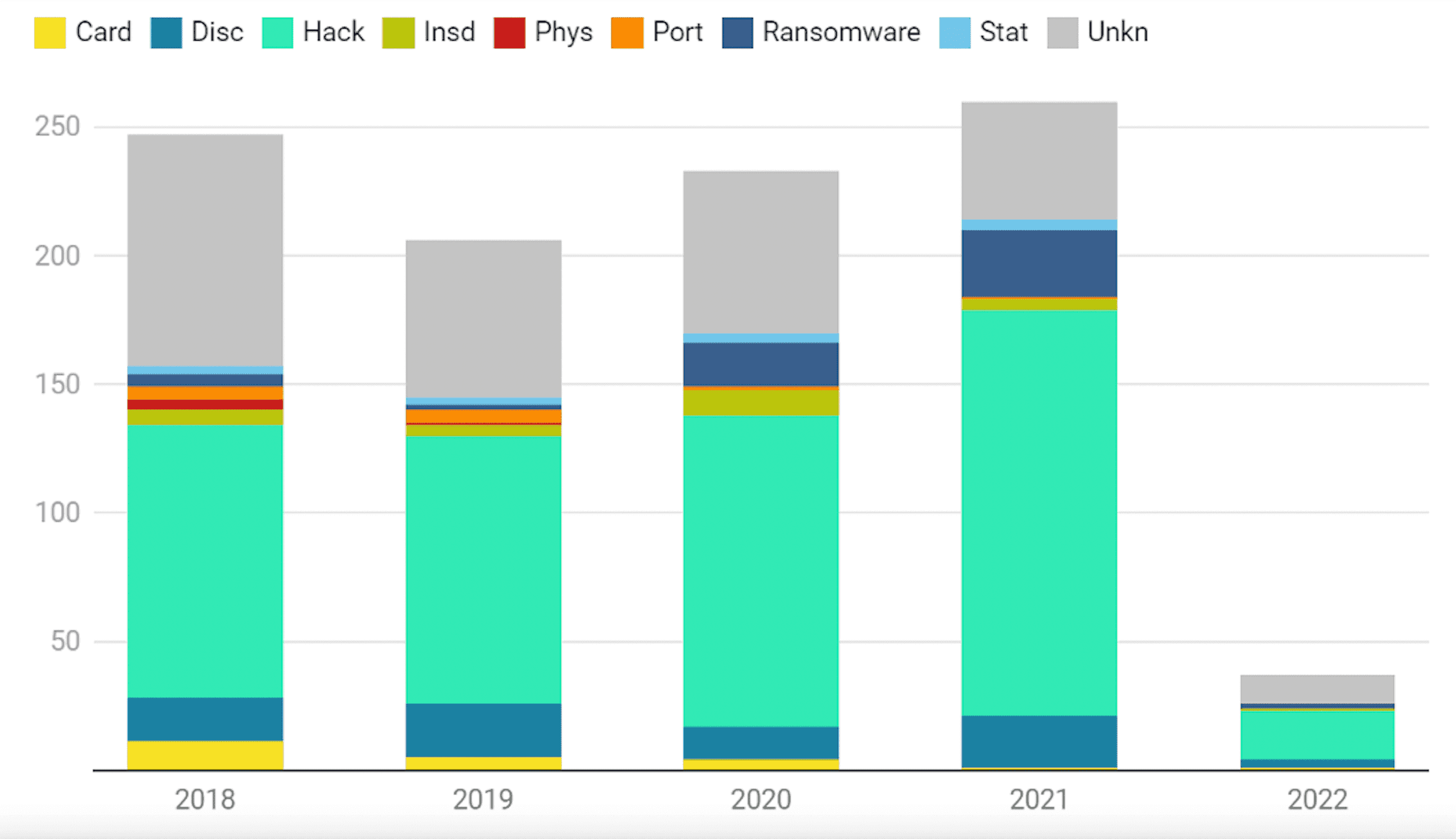

With 260 incidents, 2021 was the year with the most financial data breaches. Even though there were 247 confirmed breaches in 2018, only 3.5 million records were affected. See the chart below for the most common types of data breaches.

Image source: Comparitech

So, what are the major security challenges in the fintech field so far?

If you neglect safety precautions during app design, you open up Pandora's box of all kinds of security concerns that may strike in the future. Hackers can exploit these to gain unauthorized access, leading to potential disruption of services, financial loss, and theft of sensitive customer data. App vulnerabilities can stem from software bugs, weaknesses in encryption protocols, inadequate system updates, and insufficient authentication mechanisms. Addressing these issues is crucial, but there is more to be prepared for.

One of the top security concerns in the fintech sector is the involvement of third-party services. When you partner with external vendors and service providers, you don’t know the state of their systems’ safety. Breaches in their security could lead to potential unauthorized access or theft of customer information once you grant them access to your financial data. Additionally, since third-party services might not be under the direct control or supervision of your staff, there is an increased risk of insufficient security measures or compliance issues, which can result in significant vulnerabilities within the entire fintech ecosystem.

Cloud migration involves moving sensitive financial data and applications from on-premise infrastructure to cloud-based servers. This process can expose organizations to various risks, such as data breaches, unauthorized access, and service disruptions. All this might significantly impact the confidentiality, integrity, and availability of critical financial information and services.

Malware attacks are one of the top fintech security concerns: they can infiltrate financial systems and manipulate or steal sensitive data. Modern malicious software programs are designed to exploit various vulnerabilities left unattended, gain unauthorized access, and compromise the integrity of financial institutions' computer networks. This can lead to severe financial losses, disrupted operations, and erosion of consumer trust in fintech solutions. Additionally, malware attacks can contribute to broader cybercrime trends, such as identity theft and phishing campaigns, further endangering the financial sector's stability and security.

Human error is a major fintech security concern. It can lead to inadvertent disclosures of sensitive information, improper access controls, and susceptibility to phishing attacks. This happens when employees unintentionally share passwords, misconfigure systems, or fall for scams, compromising financial data security and transactions. Inadequate training and awareness of cybersecurity best practices further contribute to the risk associated with human error in the fintech sector.

Any app creation process, not only those used in fintech, should have security at its core. Any program should be secure by design, which means that some best practices and stringent guidelines should always be included throughout the software development life cycle.

The overall cost of the application's maintenance will be lower if security is ensured at every stage. For instance, a crucial vulnerability in a production app that necessitates a significant design modification can significantly impact time, money, and resources. Such problems would have less adverse effect if they were exposed during the design, development, or testing phases.

Thankfully, firms today are embracing DevOps services combined with SecOps, making development teams more accountable for both the infrastructure and the security.

Other important fintech application security practices are described below.

SASE (Secure Access Service Edge) delivers a comprehensive approach to protecting financial applications and their users. By providing secure access from any device, location, and network, SASE enhances data privacy while enabling seamless operations for fintech organizations. Its centralized cloud-native architecture simplifies management and ensures consistent protection across all apps, ultimately bolstering the security infrastructure of modern financial institutions.

By encrypting sensitive information, such as financial transactions and personal data, end-to-end encryption prevents unauthorized access by third parties. As the data is encrypted at the sender's end and only decrypted at the receiver's end, it guarantees secure communication and preserves the integrity of the information exchanged. This robust method of protecting data plays a crucial role in safeguarding against cyberattacks and data breaches, thus making it one of the best security solutions for fintech applications.

Secrets Management involves securely storing and managing sensitive information such as API keys, passwords, tokens, and certificates. Protecting this critical data from unauthorized access helps prevent potential security breaches and ensures the integrity of financial transactions within the application.

Authentication, Authorization, and Accounting (AAA) is a powerful security framework. How does it work? Let's break it down. Authentication refers to the process of verifying the identity of a user or device. This ensures that only authorized users are granted access to your app. Authorization determines what actions a user can perform once they have been authenticated. This prevents users from accessing sensitive information or performing potentially harmful actions.

Finally, accounting is the process of tracking user activity within your app. This includes things like login attempts, transactions, and other user actions. By monitoring user activity, you can quickly detect suspicious behavior and take action to prevent potential security breaches.

So, why is AAA such an effective security solution for fintech apps?

Tokenization is a process that replaces sensitive information with a non-sensitive or meaningless value known as a token. In essence, tokenization eliminates the need to store critical data such as credit card numbers and social security numbers on fintech apps, thereby providing users with an extra layer of protection that significantly reduces the risk of cyber fraud and identity theft.

The rapid pace of technological advancement in the fintech sector has led to innovative solutions for financial services. However, there are potential security risks that come with this progress, as fintech applications hold sensitive financial data that can be attractive to cyber attackers.

To ensure the safety and security of financial data, it is crucial for fintech application development teams to establish security measures throughout the entire software development life cycle. If you are looking for such a team, we might be able to help. Our expertise in fintech and commitment to your success are at your disposal. Let’s talk and figure out how we can help you!