The fintech industry continues to evolve rapidly, driven by significant technological advancements and shifting consumer behaviors. This article will explore the major industry challenges in 2023, including regulatory changes, data security concerns, and increasing competition. By understanding these pressures, businesses can better strategize and navigate the dynamic world of fintech software development and prepare themselves for what’s coming.

Fintech Challenges in 2023

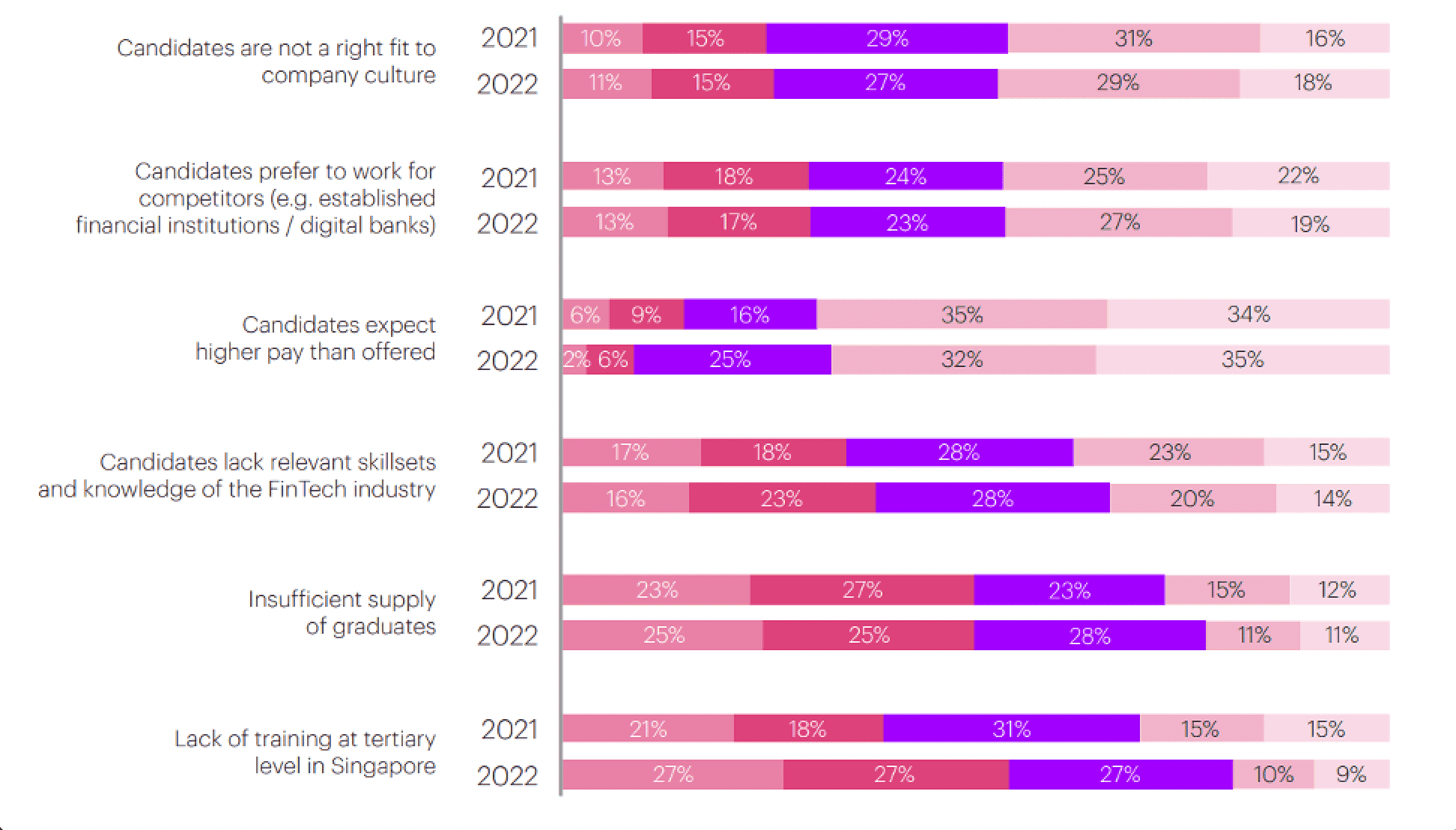

Research by the Hong Kong Institute of Bankers revealed that 90% of respondents believe that the fintech skills gap is a massive problem for the industry. This skills gap means that firms are struggling to find and attract the right talent, which can significantly stunt their growth. In a bid to stay afloat, these companies must differentiate themselves from other industries by building a compelling employee value proposition.

Accenture’s Fintech Talent report further proves that local talent is still in short supply, which has been made worse by salary inflation, rivalry from incumbents and financial institutions, and stricter work visa regulations. Fintechs continue to struggle with filling in-demand positions, keeping personnel, and exceeding their expectations despite a stable hiring appetite.

Take a look at the primary drivers of the challenges in the fintech industry talent gap in Singapore.

Source: Accenture

To retain top talent in a highly competitive market, fintech firms must be proactive and intentional about people development. They should focus on hiring for potential over mere experience, as well as partnering with other companies to execute their talent strategy. Retaining talent is critical to these organizations, as failure to do so translates to not only the high cost of hiring new staff but also disruption to the business.

Customer acquisition and revenue generation are another challenges for fintech companies. With the sector becoming increasingly competitive, standing out and capturing market share is no easy feat. Moreover, customer acquisition in the space is an intricate and costly process involving various departments, from marketing and sales to product management and UX design.

In 2020, fintech companies spent about $3 billion on client acquisition. Due to increased competition and rising customer demands, this number is expected to rise. Making effective alliances with the appropriate service providers is the key to finding the solution, according to a thought leadership paper by ISG and WNS titled Helping Fintechs Soar. These collaborations can assist in exploring new business models, co-innovating, and scaling up quickly and affordably.

Source: WNS

Service providers play the role of catalysts, bridging together developing companies and other stakeholders like investors, subject matter experts, governmental organizations, and financial institutions (seeking cutting-edge technology). What is the future of fintech with this mutually beneficial cooperation at the table? It can give companies the majority of the market share in a highly competitive industry where everyone is fighting for consumers.

Fintech firms must also leverage all available technologies to create a unique customer experience that differentiates them from the competition. This includes customizing their approach to tailor to each customer segment, a strategy that can prove to be a game-changer in the long run.

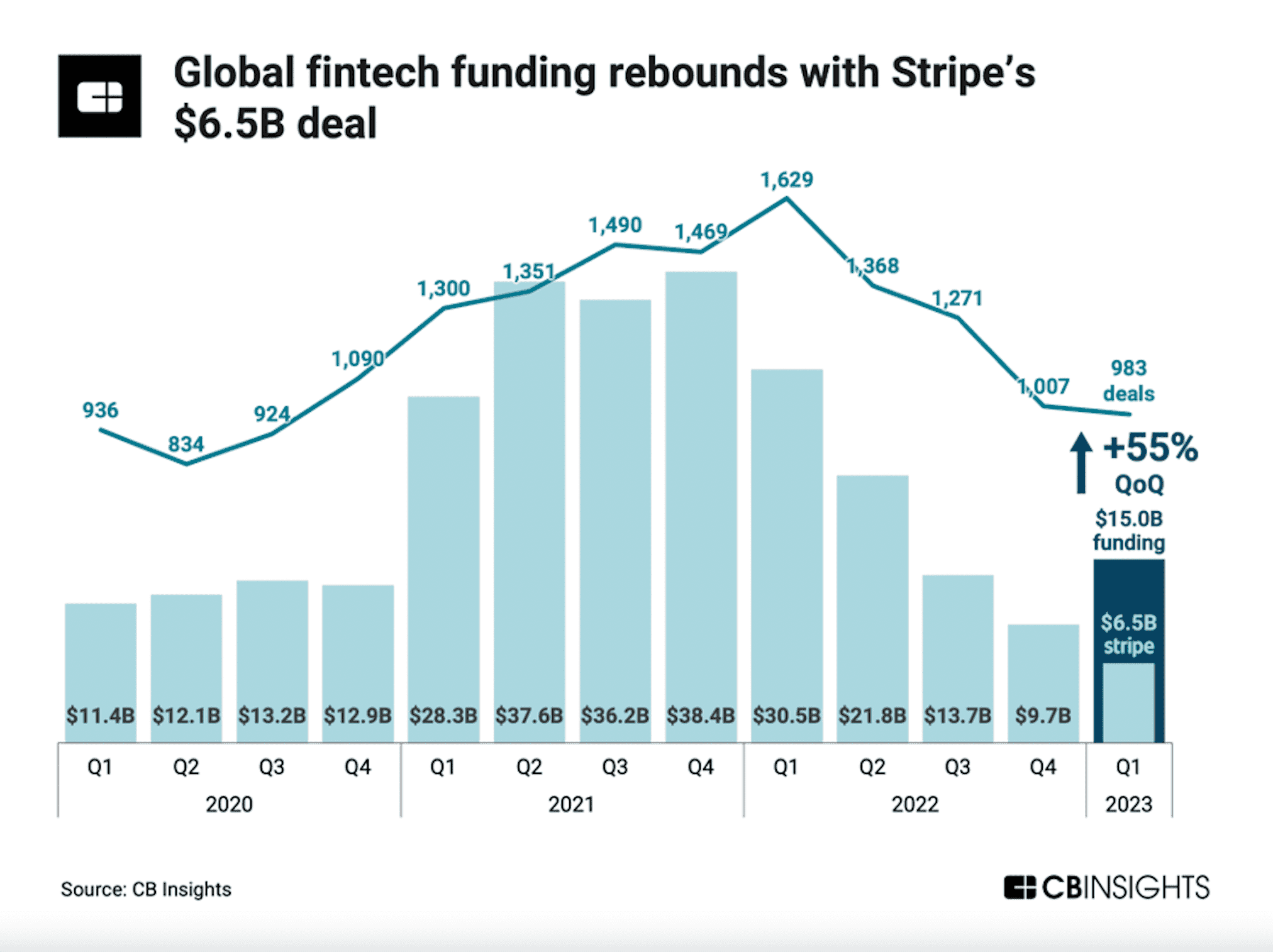

In the year 2023, finding investors and raising funds will remain some of the main challenges in the fintech industry. Amidst prevailing economic uncertainty and market volatility, attracting potential investors will require companies to offer enticing business plans that demonstrate their capacity to succeed in a competitive environment.

In addition to the stiff competition, fintech companies will have to battle with other factors that can affect their ability to secure funding. Factors such as regulatory restrictions, market saturation, and the emergence of new technologies that threaten to disrupt traditional industry offerings may also hinder their capacity to raise funds.

To successfully appeal to investors in 2023, businesses will need to adopt innovative approaches to developing their business strategies. They will need to showcase the uniqueness and creativity behind their product offerings, demonstrating to potential investors how these services can solve problems and improve customer experience.

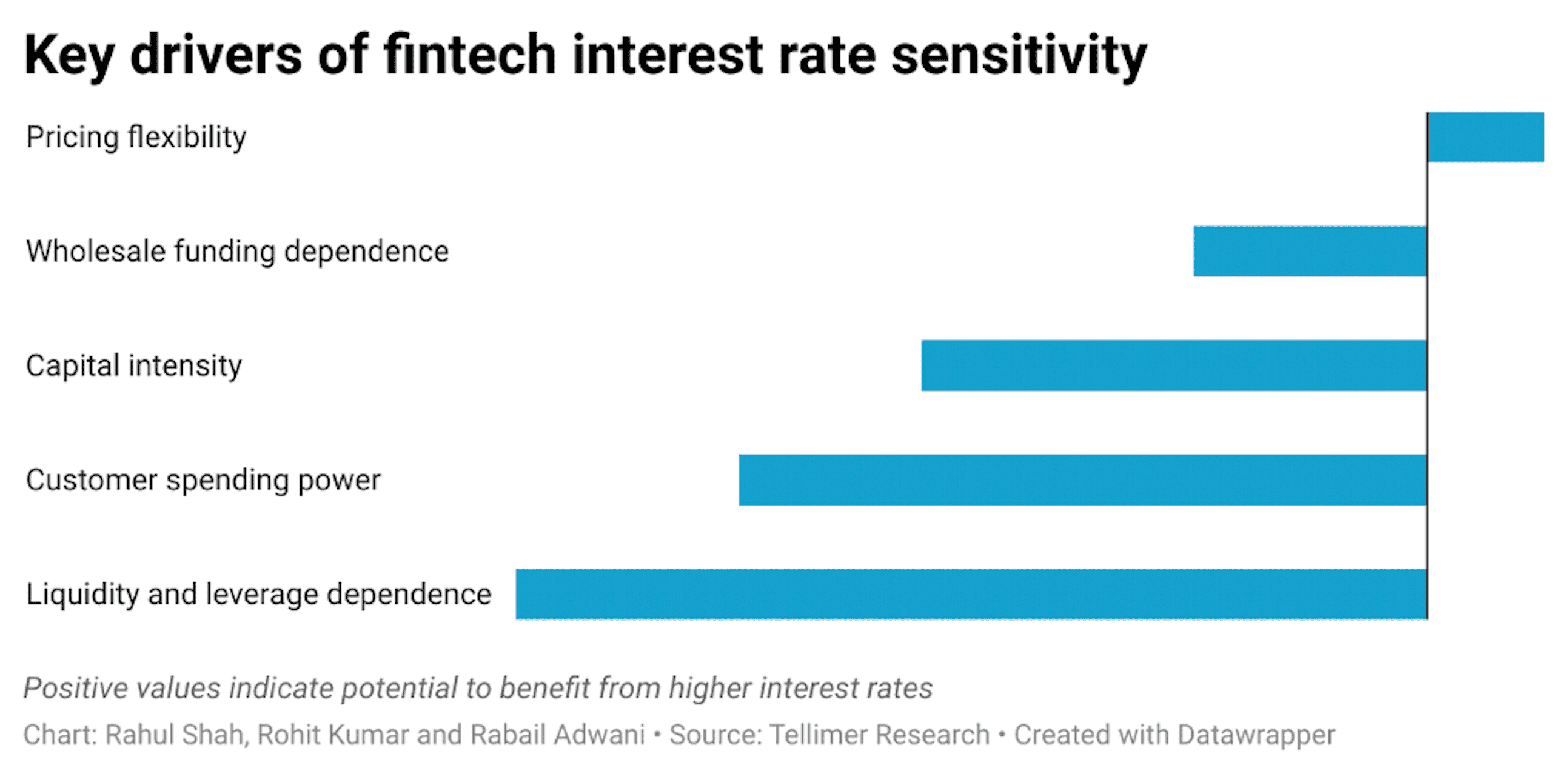

The world of fintech is undoubtedly exciting; however, the industry has its fair share of high-interest rates and the cost of capital.

Firstly, high-interest rates make it difficult for firms to borrow money at affordable rates. For instance, if a fintech company borrows money to launch a new service or expand its operations, it may have to pay a higher interest rate, reducing the business's overall profitability. This is because lenders will likely charge a higher rate to offset the potential risks associated with a new entrant in the market. As a result, companies have to look for alternative sources of funding or find creative ways to reduce their borrowing costs- a challenging task in itself.

Secondly, the cost of capital is another significant challenge faced by fintech companies in 2023. For example, if a company is looking to develop new products or services, it will need to invest significant funds to make that happen. However, such investments can be costly, and the cost of capital can keep firms from making the investment needed to innovate. This can lead to slow growth, which could be a significant disadvantage compared to competitors.

In addition to those, high-interest rates and cost of capital challenges will be compounded in some emerging markets with less-developed financial ecosystems, which may create hurdles for fintech startups operating in those regions.

Finally, it’s evident that the constantly changing regulations will continue to pose a significant challenge to the industry's growth. For fintech companies, especially those developing solutions that are not yet regulated, staying current with regulatory changes, and adapting to meet new compliance requirements can be daunting. The challenge is even steeper for start-ups, which often lack the expertise and resources to keep up with complex and ever-changing regulatory landscapes.

As it is, the industry operates in a highly regulated environment, and regulatory bodies constantly update rules and regulations to create a level playing field. Some new regulations might even require fintechs to make significant changes to their business models, technology, and operations, and this often requires substantial investments.

How can we help you achieve your digital goals?

Get in touchKey Takeaways

So, one of the biggest fintech industry challenges is regulatory hurdles as governments grapple with the need to protect consumers while fostering innovation. Acquiring and retaining talent with skill sets critical to the sector will also remain a challenge, given the rapidly evolving nature of technology in this industry. Lastly, rising competition and market saturation could lead companies to explore new avenues for growth and revenue generation, testing their ability to adapt and innovate.