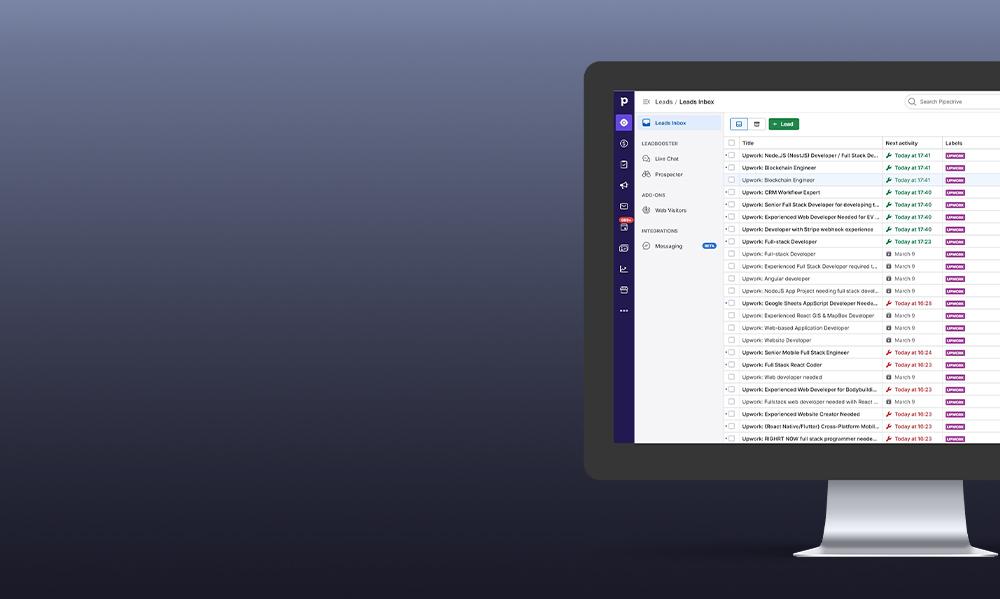

Streamline Operations and Improve Efficiency

Manual processes in the insurance industry can significantly slow down operations and limit growth potential. Utilizing advanced document management software and implementing software that automates routine tasks can drastically reduce processing times and minimize errors. Adopting modern insurance software systems helps insurance companies streamline their insurance workflows, freeing up resources for strategic initiatives rather than getting bogged down by administrative tasks.

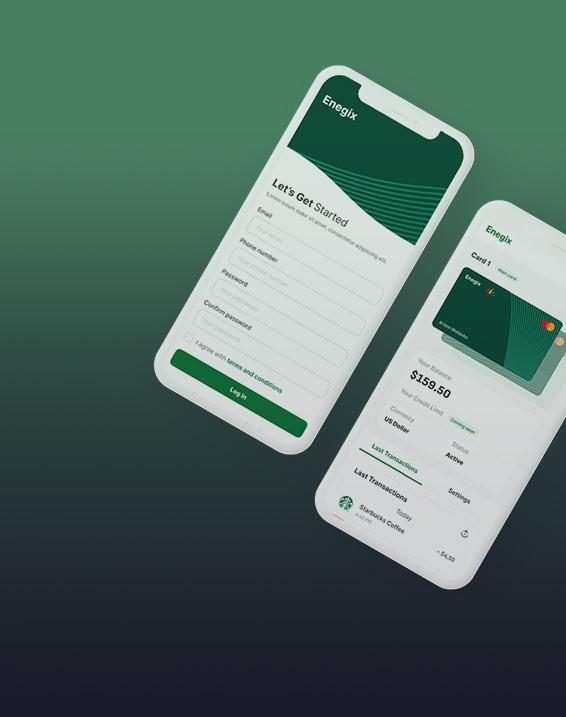

Enhance Customer Experience and Engagement

Digital-first interactions have become the norm, and insurance companies must meet these expectations. Utilizing mobile insurance apps and insurance platforms, policyholders can easily access accounts, submit claims, and view updates. This seamless user experience boosts customer satisfaction and loyalty while enabling more personalized services through integrated insurance software solutions.

Simplify Claims Processing and Management

Efficient claims management is essential for insurance companies aiming to reduce processing times and improve accuracy. Adopting claims management software that automates document submission, status tracking, and communication allows for faster claims resolution. By digitizing the entire process, insurance providers can minimize delays and enhance customer experience.