Top Fintech Trends 2023

Share this post

Global lockdowns and quarantines have shifted the focus of digital financial services onto the client. It encourages fintech businesses to stay with-it and actively adopt the newest technology to deliver the anticipated level of services and maintain a high satisfaction rate.

From AI to RegTech, there are plenty of exciting developments to keep an eye on. We’ve decided to explore some of the top fintech software development trends reshaping the industry today.

Let’s dive into the cutting-edge world of fintech!

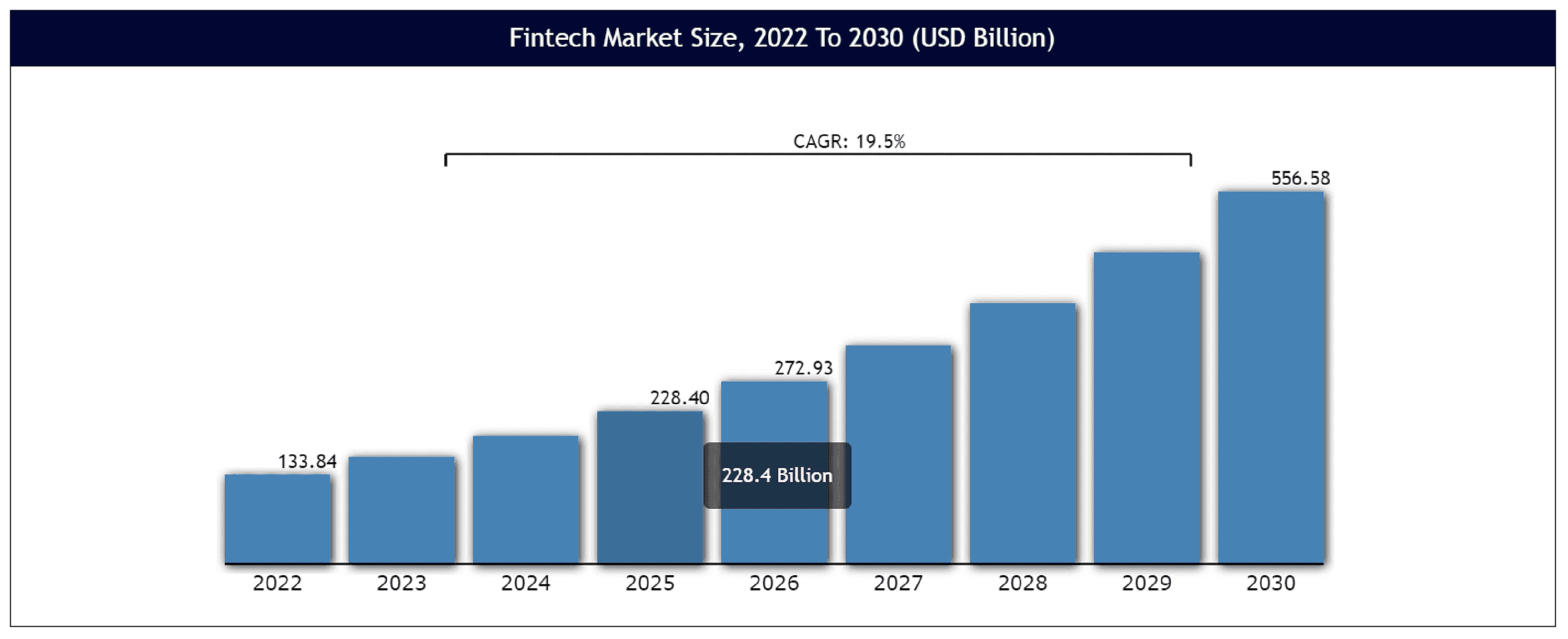

Despite the investment rate decline in 2021, fintech continues to attract the most significant funding rounds globally. The value of the global fintech market was estimated at USD 133.84 billion in 2022 and is predicted to reach USD 556.58 billion in 2030. Over the course of the forecast period, the global market is anticipated to expand at a compound annual growth rate (CAGR) of 19.50%.

Image credit: Vantage Market Research

These impressive figures represent the significance of technology utilization in finance and indicate the massive potential for further growth. The increasing use of AI, blockchain, and other emerging technologies upgrades traditional financial services into more efficient, convenient, and secure options for consumers. With rising adoption rates across industries, fintech is poised to become an even more significant player in the global economy in the coming years.

So, as we look ahead to what's next for fintech, let’s highlight some of the most critical financial technology trends that push the industry over the limits.

One of the top trends in fintech that will continue to refine the industry in 2023 is artificial intelligence (AI). The market has grown during the pandemic due to its widespread adoption by banks and financial institutions (FIs). The size of the global AI in the Fintech market, which was estimated at $8.23 billion in 2021, is expected to increase to $61.30 billion by 2031, rising at a CAGR of 22.5% between 2022 and 2031.

From chatbots to personalized investment recommendations, AI-powered tools are becoming more commonplace in the world of finance. They offer faster and more accurate processing of data, which can help reduce errors and streamline processes. What’s more, AI has made personalized investment advice possible for everyone, regardless of their level of expertise in investing. It will enable banks to provide customers with more tailored services, such as personalized risk assessments and enhanced credit scoring.

With its ability to learn from past data and apply that knowledge to future situations, ML has enabled institutions to detect fraud quickly and accurately. A Nevada-based business called Socure uses AI to combat identity fraud and digital identity theft in the banking sector. Their AI solution reduces manual assessments of IDs by up to 90% while reducing false positives in fraud detection by 13x.

Embedded finance integrates financial services into non-financial platforms like eCommerce websites and mobile apps, making it easier than ever to manage your money on the go. By embedding these services into platforms that people are already using on a daily basis - such as social media apps or online shopping sites - fintech companies can reach new customers and provide a seamless user experience.

This approach has already proven successful in areas like mobile payments, where services like Apple Pay and Google Wallet have made it easy to make transactions without ever leaving your phone. Buy Now Pay Later (BNPL) is the fastest-expanding embedded finance model. With this service, customers can make their initial purchases and spread out their payments over time. The size of the global embedded finance market, estimated at USD 65.46 billion in 2022, is anticipated to increase at a CAGR of 32.2% from 2023 to 2030.

Looking ahead to the rest of 2023, we'll likely see a growing number of businesses integrating financial services into their offerings. This could include everything from ride-sharing apps offering insurance policies to eCommerce websites providing installment payment plans for big-ticket purchases. What does this mean for traditional banks? While embedded finance may pose a threat to some legacy players, there's also a huge opportunity for collaboration and partnership between fintechs and established firms. By working together, they can offer customers a wider range of products and services while maintaining trust and security.

One or two times every month, most firms process payroll. However, recent advancements in fintech have given businesses new options for paying their staff on demand. Through a cloud-based money movement system that is available to employees as a downloadable mobile app, employers can reach on-demand pay. They can log in at any moment to view their earnings and withdraw their money as needed. It gives them the discretion to handle financial obligations as necessary during the month.

It's also about timing and cash flow; it's not merely a benefit sought by people with lower incomes or less financial means. Credit cards are still the most popular type of debt, with $756 billion in outstanding balances in the United States and £72 billion in the United Kingdom. Therefore, earlier access to earned income and financial wellness resources can alleviate cash flow issues and possibly lower the high cost of credit card debt for individuals.

Instead of relying on payday loans or high-interest credit cards, employees can use this service to avoid debt traps and improve their overall financial well-being. They can take control of their money and budget more effectively, leading to greater peace of mind and better quality of life. As consumer preferences evolve, this service will continue to gain momentum and become an essential feature of modern workplaces. It empowers individuals to achieve financial freedom.

Financial organizations have long placed a priority on areas that interact with customers. But during the past few years, businesses have been paying more attention to back-end elements as well. RegTech is one of the most vital fintech industry trends that all FIs should start embracing.

RegTech refers to the use of technology to streamline and improve regulatory compliance processes in the financial industry. Simply put, it's a set of tools and techniques that help meet legal requirements while providing customers the best possible service. Looking ahead, RegTech is poised to become an even more critical part of the fintech landscape. Since more users turn to mobile banking apps, online payment platforms, and other digital services to manage their finances, the need for robust compliance measures to protect consumer data and prevent fraud is more evident than ever.

RegTech solutions were designed to help FIs meet these challenges head-on by automating many compliance tasks that would otherwise require significant resources. Also, by leveraging AI/ML algorithms, companies can gain insights into user behavior, resulting in more personalized financial products and services that meet individual needs. Imagine a banking app that uses your transaction history to suggest investment opportunities tailored to your risk tolerance and financial goals. That's just one of the exciting possibilities RegTech could bring about in the next few years.

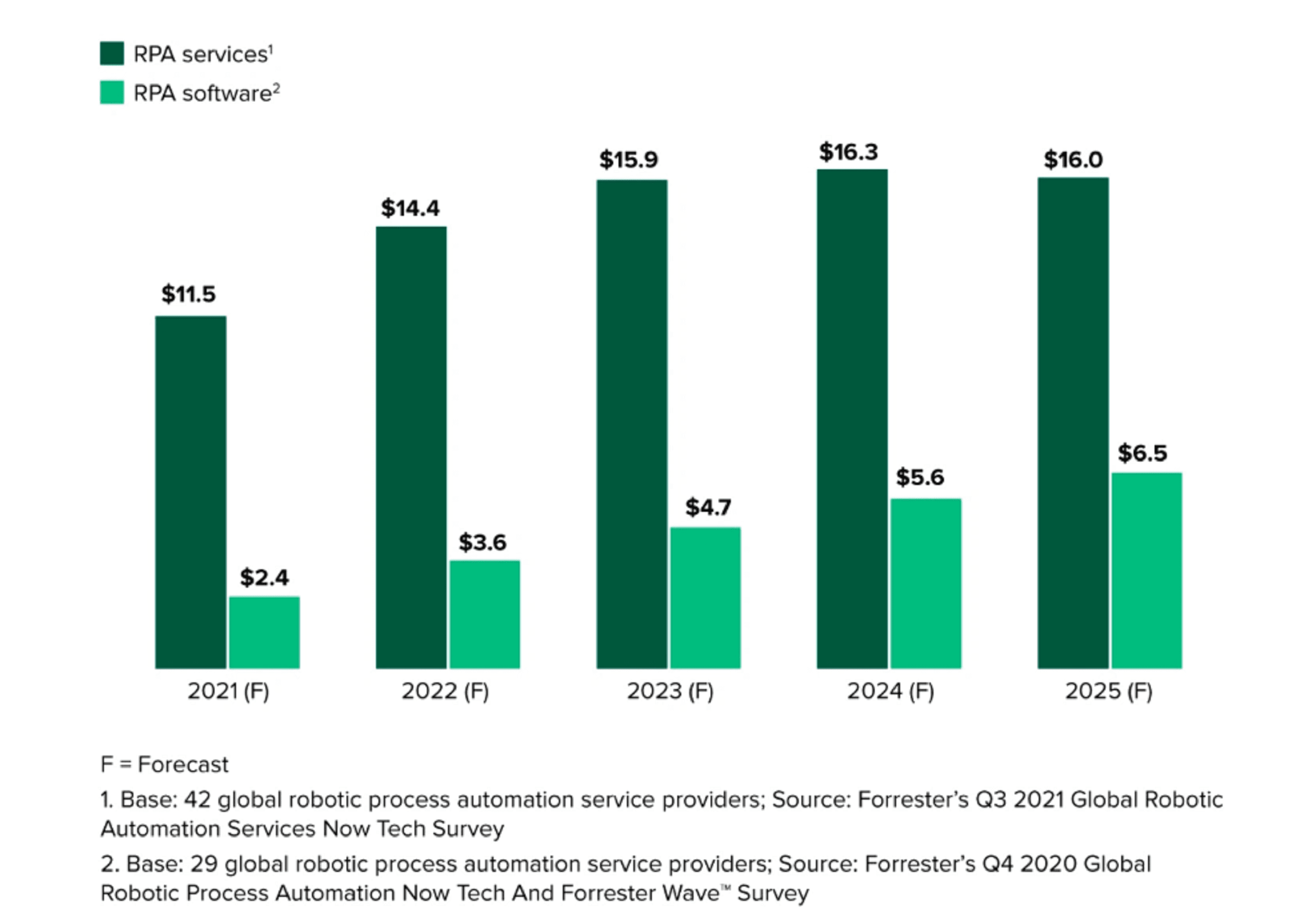

Few industries benefit from RPA more than finance and accounting. Robotic Process Automation technology eliminates repetitive and time-consuming tasks freeing up valuable resources for more strategic initiatives. How does it work? Via automation of source-consuming jobs using software robots to mimic human actions. These robots can be programmed to perform a wide range of functions, such as data entry, document processing, account management, etc. The result is reduced errors and significant cost savings for FIs.

RPA works by integrating with existing systems and apps used within an organization. It then uses advanced algorithms and ML capabilities to identify patterns in data and perform tasks based on these patterns. This enables organizations to streamline their processes and improve overall productivity.

According to the most recent research from Forrester Research, the RPA software industry will rise to $6.5 billion by 2025. However, as businesses switch to more AI-driven automation solutions, growth will begin to level down.

Image credit: TechCrunch

At its core, wealth tech, just like other trends in fintech, is all about leveraging technology to help individuals manage their wealth in a smarter, more efficient way. This includes everything from digital investment platforms that offer low-cost investing options to automated financial planning tools that can help you build and track your long-term financial goals.

One of the most exciting aspects of wealth tech is its ability to democratize access to financial services. Thanks to advances in technology, investors no longer need to have large amounts of capital or personal connections with high-profile advisors to get started. With robo-advisors and other automated solutions, anyone can start building an investment portfolio regardless of their background or experience level.

With further integration of AI and ML, RPA will become even more brilliant and capable of handling more complex tasks. This will enhance not only operational efficiency but also enable FIs to deliver excellent customer service.

Trends in fintech demand innovation and flexibility. One of the most exciting innovations that has come about in recent years is the use of microservices and modularity. These approaches to software development allow companies to create more efficient, scalable systems that can adapt to changing market conditions.

Microservices are small, independent pieces of software that work together to form a more extensive application. Each microservice is responsible for a specific task or set of tasks and communicates with other microservices through well-defined interfaces. This approach allows developers to focus on one piece of the puzzle at a time, making it easier to update and maintain individual components without affecting the entire system.

Modularity takes this idea even further by breaking down applications into discrete modules that can be added or removed as needed. This approach provides greater flexibility and agility, allowing companies to respond quickly to changes in customer needs or business requirements. It also makes it easier to incorporate new technologies and services into existing systems, creating a more dynamic ecosystem that can evolve over time. In the world of fintech, these innovations are particularly important because they enable companies to stay ahead of the curve in a rapidly changing landscape.

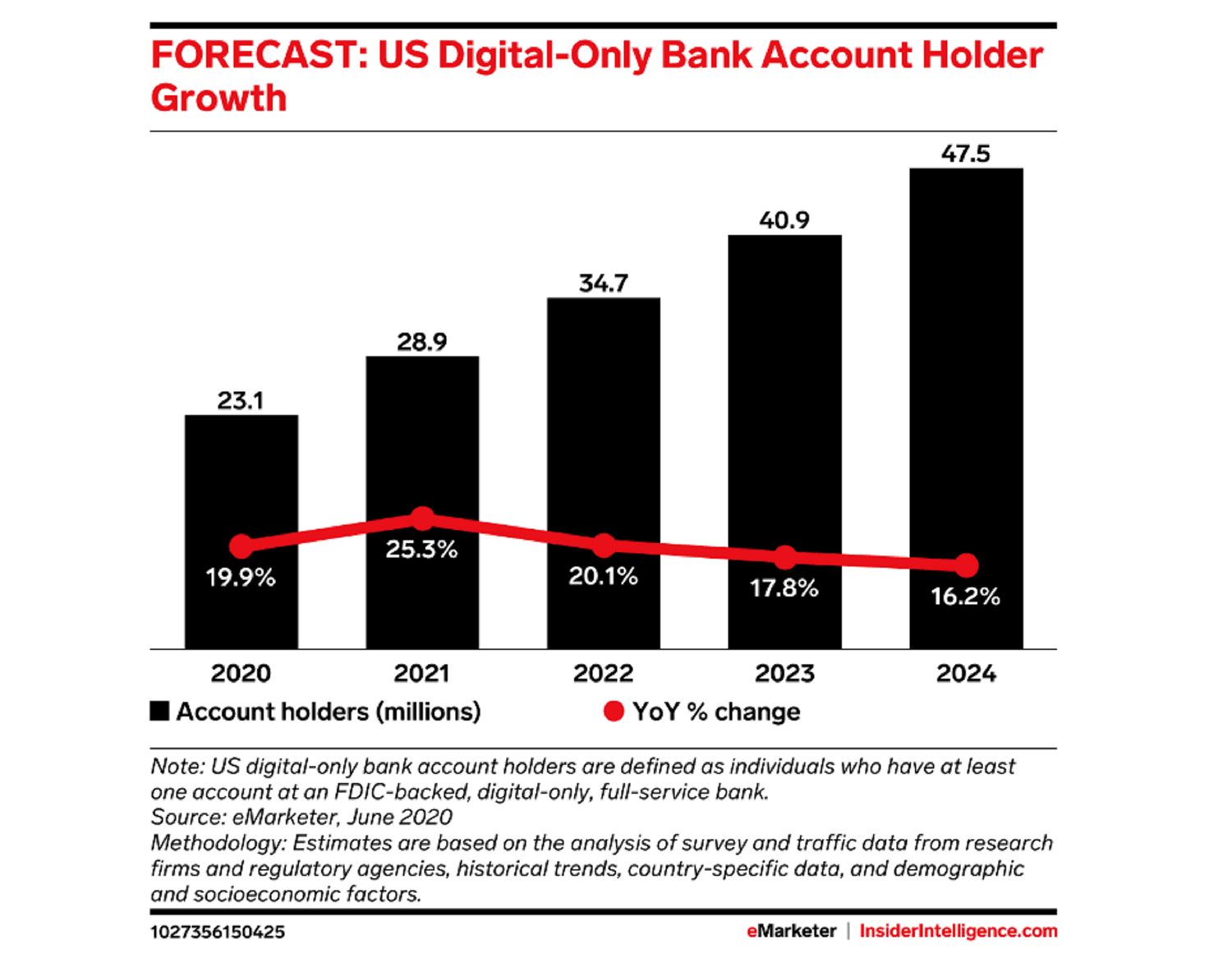

We've learned from the pandemic that we can accomplish everything from home, and the financial sector has taken this lesson seriously. Neobanks, which resemble conventional banks but are virtual institutions, have expanded as a result of fintech. With features like mobile check deposits, budgeting tools, and 24/7 customer support, virtual banking make our finances more manageable and more accessible than ever before.

While it is a relatively new concept in the world of finance, it is quickly gaining popularity.

Image credit: Business Insider

Neobanks operate solely online and often offer a range of features that traditional brick-and-mortar institutions cannot match. For instance,easy-to-use mobile apps allow customers to manage their finances from anywhere at any time. With just a few taps on your smartphone, you can transfer funds, check your balance, or pay bills.

Regarding innovation, virtual banks have embraced emerging technologies like AI and blockchain to create more personalized services for users. This means that customers can expect better insights into their spending habits, customized investment recommendations, and real-time alerts about suspicious activity. Furthermore, one of the most significant benefits of neobanking is its accessibility. Traditional banks may require a minimum account balance or impose hidden fees, making them unaffordable for many people. Neobanks, on the other hand, typically do not have these restrictions, which means that anyone with an internet connection can open an account.

This democratization of finance has the potential to change lives by providing financial services to underbanked populations who were previously excluded.

According to Statista, gamification spending rose sharply from $4.91 billion in 2016 to $11.94 billion in 2022. It has also been a hot topic in fintech, and for a good reason. By incorporating game-like elements into financial technology, companies are able to engage users on a deeper level and make managing finances more enjoyable.

Gamification refers to the integration of game-like features into non-game contexts. By incorporating elements like points, rewards, and leaderboards, companies can incentivize users to spend more time interacting with their financial tools. This not only helps keep users engaged but also encourages them to take a more proactive approach to managing their money.

A great benefit of gamification is that it improves financial literacy. Games provide an intuitive and interactive way for users to learn about complex financial concepts and how to apply them to real-life situations. By playing games that simulate financial scenarios or require users to make decisions based on financial knowledge, users can develop a deeper understanding of finance without feeling overwhelmed or bored.

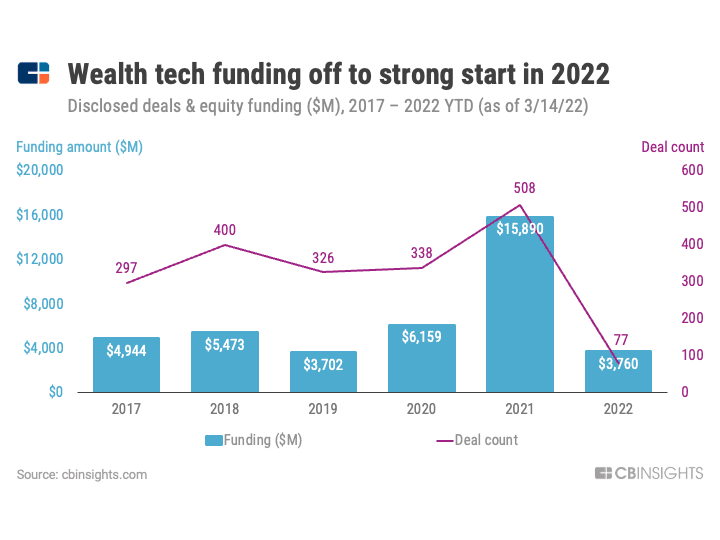

With transaction count up 27% from the previous peak established in 2018 and dollars more than doubled from 2020, wealth tech funding reached records in 2021. And if things continue as they are, 2022 might set a new funding record for wealth technology.

At its core, wealth tech, just like other trends in fintech, is all about leveraging technology to help individuals manage their wealth in a smarter, more efficient way. This includes everything from digital investment platforms that offer low-cost investing options to automated financial planning tools that can help you build and track your long-term financial goals.

One of the most exciting aspects of wealth tech is its ability to democratize access to financial services. Thanks to advances in technology, investors no longer need to have large amounts of capital or personal connections with high-profile advisors to get started. With robo-advisors and other automated solutions, anyone can start building an investment portfolio regardless of their background or experience level.

The importance of financial technology trends cannot be overstated. They have brought about greater convenience, speed, and accessibility to consumers worldwide. These innovations are not only beneficial to consumers but also help FIs streamline their processes and reduce costs. Novel technologies have enabled small businesses to access funding easily through online platforms that connect them with investors. But new trends come without their challenges. The most pressing issue in fintech (especially with neobanks trending) is security concerns regarding personal and sensitive data stored online. FIs must ensure that they have robust security measures in place to protect their customers' data.

Are you struggling with your fintech project? Let us help. We have the expertise you need to bring your idea to life. Contact us today, and see what the Clover Dynamics team can do for you!