A reverse mortgage is based on many factors, and depending on these factors, the loan officer should determine one of the scenarios for the prospect.

Web Platform for Reverse Mortgage Calculation

Darling Financial Services is a company that specializes in providing financial services. Their board includes loan officers who assist prospects in calculating reverse mortgages.

Before coming to us, the client used an Excel spreadsheets with a reverse mortgage calculator that processed a lot of data. Updating this data required considerable effort, so the client wanted to optimize this process by creating a web platform with a calculation system. This platform would reduce the manual work of loan officers and, by entering the minimum amount of data, produce the most accurate and correct results.

The application is a Reverse Mortgage Pre-Qualification Engine. It is a web platform where the user enters data (age, credit history, state, etc.), and the system calculates the reverse mortgage according to predefined scenarios automatically selected by the system.

Clover Dynamics developed a unique calculation engine, leveraging our expertise in Custom Software Development and ensuring operational efficiency. The uniqueness is demonstrated by the tailored data processing according to the input data, with all calculations based on advanced formulas. This solution exemplifies our commitment to providing a competitive edge and addressing the technical resource gap.

The calculation results provide detailed graphs and numerical data, such as increased funds, line of credit, and monthly payments based on years from the reverse mortgage. Additionally, the platform offers other graphical representations of how the payments will occur, ensuring comprehensive and transparent insights for users. By integrating our AgilePulse™ methodology and strong data protection measures, we ensure that the system is both adaptive and secure.

Our interdisciplinary team, guided by dedicated project management and continuous CTO oversight, collaborated closely to deliver a relationship-centric and scalable solution.

The features

The result

- 01

Enabled efficient and accurate reverse mortgage calculation services for prospects, significantly improving client interactions and satisfaction

- 02

Minimized the manual workload for loan officers, allowing them to focus on higher-value tasks and enhancing overall productivity.

- 03

Streamlined the data processing and calculation workflows, leading to a more efficient operation and quicker turnaround times for reverse mortgage calculations.

- 04

Leveraged advanced algorithms and quality control measures to ensure precise and reliable mortgage calculations, reducing errors and increasing trust in the service.

Full case study

More Case Studies

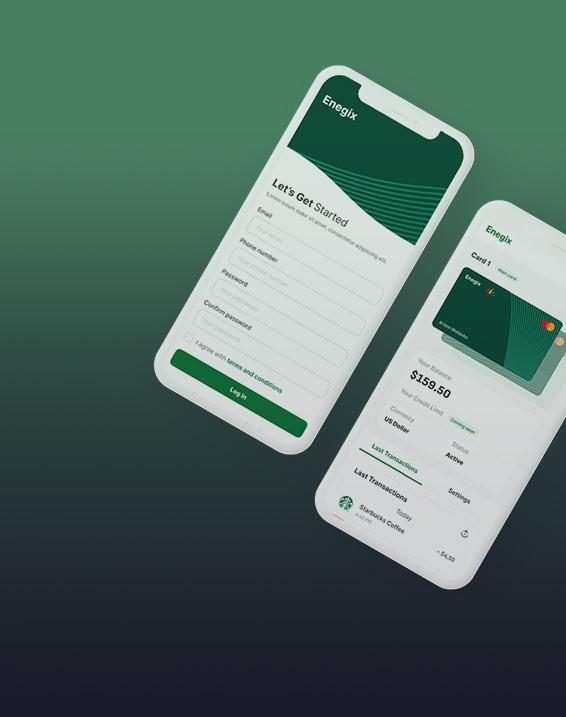

Cryptocurrency Exchange Platform Development for Enegix

This client is a large hosting data center embarked on fulfilling its ambitious goal to revolutionize the cryptocurrency exchange landscape. This corporation is a significant player in the business of web hosting, virtual private servers, and cloud storage aimed to diversify its offerings and reinforce its stance as a leader in the technology sphere.

Finance Management System Software for European Legal Company

Our client is a European legal company that provides legal services for the B2B segment.

Turn AI uncertainty into measurable ROI with proof of concept validation

Frequently asked questions

Custom reverse mortgage calculation software is essential for addressing the specific needs and complexities of reverse mortgage products. Unlike standard mortgage software, reverse mortgages involve unique calculations for loan amounts, equity considerations, and payment disbursements that must account for borrower age, home value, interest rates, and regulations. A tailored solution ensures these factors are accurately managed, improving the overall client experience, compliance, and efficiency in mortgage processing.

Clover Dynamics' reverse mortgage software enhances accuracy by automating complex calculations and reducing the risk of human error. It includes algorithms that handle variable rates, changing equity values, and other factors with precision. The software’s automated validation checks and real-time updates to interest and equity values further improve accuracy, enabling lenders to provide faster, more reliable quotes and calculations.

Clover Dynamics’ reverse mortgage software offers an AI-Calculation Engine for precise, variable-based calculations, and Graph Generation to visualize loan scenarios over time. It integrates seamlessly with Quantum Reverse for streamlined data sharing and allows Scenario-Based Calculations for comparing loan outcomes. Additionally, Automated PDF Generation and Email Delivery enable quick, professional client communications with detailed loan reports.

Reverse mortgage calculation software is designed to be highly scalable, accommodating lenders of various sizes and transaction volumes. It’s also customizable to meet specific lender requirements, allowing for the adjustment of parameters like loan-to-value ratios, eligibility criteria, and branding. This flexibility makes it easy to integrate unique workflows and scale as a lender’s business grows, supporting ongoing adaptability in a dynamic market

Yes, Clover Dynamics' reverse mortgage software is built with integration in mind. It uses open APIs to facilitate seamless connectivity with popular loan management systems, CRM software, and accounting platforms. This integration capability enables lenders to streamline operations, reduce duplicate data entry, and maintain a centralized view of client information, making the entire reverse mortgage process more efficient.